July 01, 2024

Deploying a group-wide compliance and risk management framework that caters to individual regulatory requirements in each location requires careful and well-tho...

Read more about this post

June 28, 2024

Monaco and Venezuela were added to the Financial Action Task Force's (FATF) list of Jurisdictions under Increased Monitoring, also known as the FATF grey list....

Read more about this post

June 18, 2024

Just when you thought everything was under control, you realise that things have already changed. Again....

Read more about this post

June 05, 2024

If your AML Compliance system is made up of a hotch-potch of tools, spreadsheets, and manual processes, it is all very fragile....

Read more about this post

May 20, 2024

Empower your people to perform their job well, boost their motivation, reduce employee turnover, and help them face the customer with...

Read more about this post

April 25, 2024

It is not surprising that a new customer’s onboarding experience is a major influence on a company’s Net Promoter Score, and not only ensures that your customer...

Read more about this post

April 08, 2024

InScope-AML keeps us abreast of sanctions, adverse media and political exposure of our new and existing customers and keeps track of document expiry dates. InSc...

Read more about this post

March 14, 2024

Teaching new employees to work on AML compliance software is the easiest way to get them up and running in the shortest time as such software covers a very larg...

Read more about this post

February 23, 2024

Kenya and Namibia were added to the Financial Action Task Force's (FATF) list of Jurisdictions under Increased Monitoring, also known as the FATF grey list. Bar...

Read more about this post

February 14, 2024

Services are built on trust, and this is even more true in the provision of professional and financial services. Which is why protecting your reputation is so i...

Read more about this post

February 01, 2024

Human discretion and errors have no place in AML Compliance Management. It has no place in one-person practices, let alone larger companies, as the related peri...

Read more about this post

January 25, 2024

With InScope-AML we are now able to obtain the information we need to compile a large part of the FIAU REQ simply by accessing the solution’s report section....

Read more about this post

January 25, 2024

There is a higher cost related to AML compliance that some people often overlook. That of non-compliance. This is where AML compliance software can help....

Read more about this post

November 23, 2023

With proper planning in advance, the process of completing and filling in the REQ can be without stress....

Read more about this post

November 16, 2023

In this interview we speak to Rian Hancock, CEO at Africa NewLaw, about the impact that grey listing had on legislation and regulation and how this in turn impa...

Read more about this post

October 27, 2023

Bulgaria was added to the Financial Action Task Force's (FATF) list of Jurisdictions under Increased Monitoring, also known as the FATF grey list. Panama, Cayma...

Read more about this post

October 06, 2023

Data Quality is a crucial aspect in AML Compliance Management since effective management of this function is only as good as the data it uses....

Read more about this post

September 14, 2023

You cannot claim to “know your client” if you’re not leveraging external data and information that the rest of the world already knows about your client. This a...

Read more about this post

September 02, 2023

InScope-AML, a European developer of AML (Anti-Money Laundering) compliance management solutions, and Regula, a global developer of forensic devices and identit...

Read more about this post

August 03, 2023

Our mission of making AML compliance easier for affected companies is resonating very well with our target markets, and the future looks very bright....

Read more about this post

July 14, 2023

“With InScope-AML we will assist our clients turn AML compliance from a cost centre to a strategic enabler. We are bringing InScope-AML on board at an affordabl...

Read more about this post

June 26, 2023

Cameroon, Croatia, Vietnam were added to the Financial Action Task Force's list of Jurisdictions under Increased Monitoring, also known as the FATF grey list....

Read more about this post

June 13, 2023

This prestigious accreditation by the ICAEW is yet another confirmation of the international appeal of InScope-AML....

Read more about this post

April 18, 2023

“We're looking for Partners! The market for AML Compliance Management solutions is booming, and this is the right time for like-minded companies to get on board...

Read more about this post

March 15, 2023

Take this test to determine if you and your team are on top of things, or if things will very soon get out of control....

Read more about this post

March 03, 2023

An overview into how an InScope-AML user can gather the required information for the 2023 FIAU REQ submission....

Read more about this post

March 01, 2023

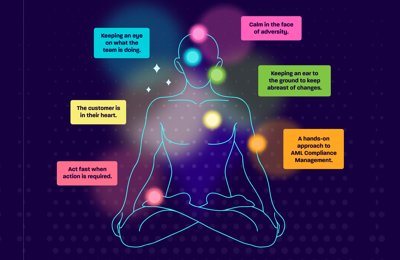

Change is constant. But MLROs don’t need to be constantly on the go, firefighting their way through the compliance management process....

Read more about this post

February 24, 2023

Nigeria and South Africa were added to the Financial Action Task Force's list of Jurisdictions under Increased Monitoring, also known as the FATF grey list. Cam...

Read more about this post

February 22, 2023

We are pleased to launch our first series of InScope-AML Open Forum AML Training and at the same time give you an opportunity for personal development and addin...

Read more about this post

February 13, 2023

In this article we look at what the FATF is and why the organisation plays a big role in fronting the world-wide fight against money-laundering and terrorist fi...

Read more about this post

January 30, 2023

As MLROs face more and more compliance pressures, customer experience is bound to suffer. InScope-AML was built to provide a great customer experience by simpli...

Read more about this post

January 19, 2023

Successful MLROs use AML software. They don't rely on manual processes & spreadsheets. More efficient; more effective; No last-minute panic!...

Read more about this post

January 07, 2023

It’s that time of the year, again. It’s going to be a breeze, because everything is organised, and the information you need to fill in the FIAU’s Risk Evaluatio...

Read more about this post

November 18, 2022

“It was very evident, from the word go, that the InScope-AML team had done all this many times before. They were very clear about the process and the steps ahea...

Read more about this post

October 31, 2022

This article explores the Economic Crime and Corporate Transparency Bill, which has passed through the second reading in the UK House of Commons and is currentl...

Read more about this post

September 30, 2022

Understanding your customer's “Source of Wealth” (SOW) and “Source of Funds” (SOF) is an important part of any Know Your Customer (KYC) process. In this article...

Read more about this post

September 06, 2022

Staying compliant with AML regulations has never been more challenging. But a lot of firms struggle to set up robust AML practices and adhere to them consistent...

Read more about this post

August 31, 2022

Matt Rizzo is one of the co-founders of InScope-AML, and has been the CEO since 2018. We caught up with him to discuss developments in the fight against money l...

Read more about this post

August 24, 2022

Managing AML risk at the customer level is a fundamental component of an effective Anti-Money Laundering process. Here are five steps to ensure you remain on to...

Read more about this post

August 17, 2022

The team behind InScope-AML is driven by our main message: “Compliance Made Easy”. In this article we look at how we go about ensuring that InScope-AML assists...

Read more about this post

August 03, 2022

The term Risk-Based Approach (RBA) is used extensively in conjunction with Anti-Money Laundering. In this post, we explore the various ways it can be implemente...

Read more about this post

July 27, 2022

Accountants, lawyers, tax advisors, TCSPs and other professionals that are subject to the UK's Anti-Money Laundering regulations may find it challenging to keep...

Read more about this post

July 21, 2022

Accountants, lawyers, tax advisors, TCSPs and other professionals that are subject to the UK's Anti-Money Laundering regulations may find it challenging to keep...

Read more about this post

May 24, 2022

The UK CCAB has just published its updated guidance on AML and CFT for accounting professionals related to the obligations under UK legislation. The guidance is...

Read more about this post

May 16, 2022

One of the clearest indications that things are not right in any system for managing AML compliance is the pervasive use of spreadsheets. Where do we begin in e...

Read more about this post

April 03, 2022

“They have provided an impeccable service from day one, always making things happen when we required their support. This, in my opinion, is the most important f...

Read more about this post

February 15, 2022

We immediately felt that InScope-AML as a solution ticked all the boxes, and the team behind the product could speak our language and adapt the solution to our...

Read more about this post

January 15, 2022

NCMB Consulting assists local and international clients which use Malta as a base for their commercial activity. The company offers best-in-class tailor-made se...

Read more about this post